The highest return on energy renovations comes from upgrades that eliminate future risks for buyers, not just from raw energy savings.

- Systemic upgrades like attic insulation should precede component replacements like windows or HVAC to maximize value.

- Choosing technology that avoids “obsolescence risk”—such as heat pumps over gas furnaces—is a key valuation signal.

- The sequence and integration of projects are as crucial as the hardware itself for achieving a positive return on investment.

Recommendation: As an appraiser, I advise focusing on building a compelling narrative of a low-risk, comfortable, and future-proofed home to justify a premium valuation at resale.

As a homeowner, you’re faced with a constant stream of advice on how to improve your property. The promise is twofold: a more comfortable living space today and a higher sale price tomorrow. When it comes to energy renovations, however, the path to a positive return on investment (ROI) is notoriously murky. Many homeowners invest thousands in upgrades that, from a market valuation perspective, amount to little more than personal preference. They focus on the hardware—the new furnace, the shiny smart thermostat—without understanding what a potential buyer truly values.

The common wisdom suggests focusing on big-ticket items like windows or chasing every available government rebate. While these elements have their place, they often miss the fundamental principle of property valuation. A buyer, and by extension their appraiser, is not just purchasing a set of features; they are investing in an asset and assessing its future liabilities. The most valuable renovations are not necessarily the most expensive ones, but those that systematically de-risk the property for the next owner.

But what if the key to increasing your home’s value wasn’t just adding new things, but strategically eliminating future problems? This is the core of an appraiser’s analysis. It’s about understanding market perception, technological obsolescence, and systemic synergy. This article will deconstruct energy renovations through that lens. We will explore which upgrades act as powerful valuation signals, why the order of operations is critical to your ROI, and how to avoid investing in gadgets that will be liabilities in just a few years. It’s time to move beyond simple payback calculations and learn to think like the market.

This guide breaks down the key decisions you’ll face, providing an objective, valuation-focused perspective. The following sections will equip you with the insights needed to make smart, profitable renovation choices.

Summary: A Valuation-Focused Guide to Profitable Energy Renovations

- Why Buyers in Cold Climates Pay More for Triple Glazing?

- How to Stack Grants to Pay for 50% of Your Heat Pump?

- Heat Pump or Gas: Which Will Be Obsolete in 10 Years?

- The Smart Home Mistake: Installing Gadgets That Age Badly

- When to Replace Windows: Before or After Facade Painting?

- When to Upgrade Windows: Before or After Insulating the Attic?

- Why Is It So Hard to Find High-Yield Properties in Major Cities?

- Why Modern Drywall Might Be Making Your Family Sick?

Why Buyers in Cold Climates Pay More for Triple Glazing?

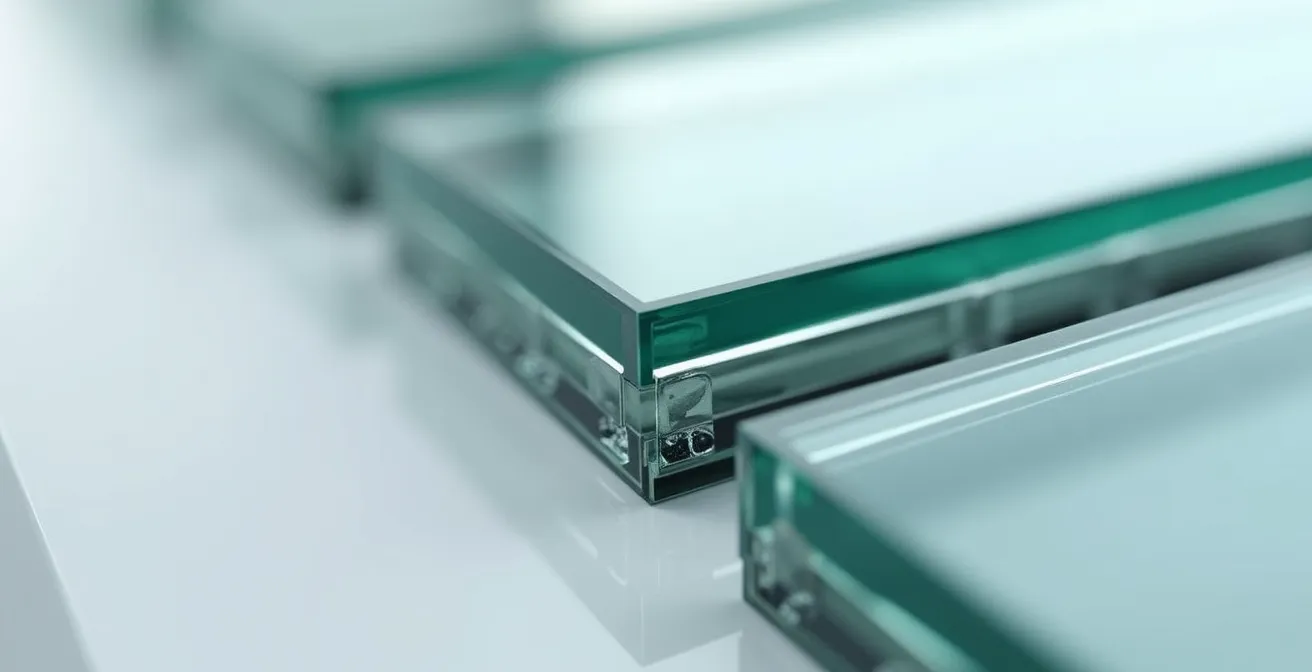

In a real estate appraisal, value is often a reflection of market expectations. In cold climates, as buyers become more educated about energy performance, triple-glazed windows are shifting from a luxury feature to a powerful valuation signal. They tell a story of a well-built, comfortable, and efficient home. This perception is grounded in superior performance; triple glazing significantly outperforms double glazing, with some studies showing 44% less heat loss. This isn’t just an abstract number; it translates to tangible comfort (no cold drafts near windows) and lower, more predictable utility bills—a key concern for buyers in colder regions.

To understand the technology behind this value, it’s helpful to visualize its components. The multiple panes of glass with inert gas fills create a robust thermal barrier that conventional windows lack.

As this cross-section illustrates, the engineering is focused on eliminating thermal bridging and maximizing insulation. From a valuation standpoint, the market precedent is already set in colder international markets. For instance, in Norway, where harsh winters are the norm, 60% of buildings are equipped with heat pumps and triple glazing is standard, while Sweden and Finland are not far behind. This widespread adoption demonstrates that in mature markets, these features are expected and command a premium because they directly address a primary homeowner concern: staying warm without exorbitant cost. An appraiser in a developing cold market sees this trend and recognizes the future-proofing value it represents.

How to Stack Grants to Pay for 50% of Your Heat Pump?

A significant factor in the valuation of any home improvement is its net cost to the owner. While a high-efficiency heat pump is a powerful upgrade, its upfront expense can be a barrier. However, a strategic approach to incentives can dramatically lower this cost, directly boosting the project’s ultimate ROI. From an appraiser’s perspective, a homeowner who effectively “stacked” grants has not only acquired a superior asset but has done so with financial prudence, maximizing the value added per dollar spent. The key is understanding that these programs—federal, state, and utility—are not mutually exclusive and can often be combined.

Successfully navigating this landscape requires a specific order of operations, as some programs have prerequisites or funding caps that are met quickly. For many homeowners, a realistic stack of incentives can reduce net costs by a significant margin. Reports indicate that a homeowner who properly layers these programs can realistically reduce costs by $3,000 to $12,000, effectively cutting the project cost in half in some cases. This reduction in initial outlay makes the upgrade’s contribution to the home’s value far more impactful.

Achieving this requires meticulous planning and documentation. It’s not simply about applying for money; it’s about building a case for each rebate and ensuring all technical requirements are met. The following checklist outlines the critical path most homeowners should follow to maximize their financial return.

Action Plan: The Strategic Grant Stacking Sequence

- Secure the utility rebate first, as this often requires pre-approval before work begins.

- Apply for state-level rebates (like HEEHRA) next, paying close attention to income qualifications and deadlines.

- Document all equipment and installation costs meticulously for the federal 25C tax credit, which is claimed on your annual tax return.

- Check for any additional local municipality or county programs that are designed to stack with other incentives.

- Keep all AHRI certificates, invoices, and correspondence for each program as proof of compliance for future records.

Heat Pump or Gas: Which Will Be Obsolete in 10 Years?

When evaluating a home, an appraiser must consider not just its current condition but also its long-term viability. This is where the concept of obsolescence risk becomes critical. Today, the choice between a heat pump and a natural gas furnace is a pivotal decision that will significantly impact a home’s future marketability. While gas has been the standard for decades, mounting evidence suggests it is becoming a depreciating asset. Policies in numerous jurisdictions are moving towards phasing out gas hookups in new construction, and the emissions profile of gas heating is fixed, unlike an electrical grid that gets progressively cleaner.

From a performance and environmental standpoint, the data is compelling. A modern heat pump is not just a heater; it’s an efficient air conditioner as well, providing year-round climate control in one unit. Furthermore, replacing gas furnaces with heat pumps results in emissions reductions for 98% of US homes. This “green” aspect is no longer a niche interest; it’s a measurable quality that a growing segment of buyers actively seeks and is willing to pay for. A home with a gas furnace may soon be viewed as having a built-in, expensive replacement project on the horizon, a liability that a savvy buyer will factor into their offer.

The forward-looking valuation difference between these two technologies is stark when viewed through the lens of market trends, policy direction, and operational efficiency. The table below provides a clear, data-driven comparison for any homeowner weighing this critical decision.

| Factor | Heat Pump | Gas Heating |

|---|---|---|

| Emissions Trajectory | Decreasing as grid gets cleaner | Fixed at 1 lb CO2 per 10 cu ft forever |

| Efficiency | 200-400% (COP 2-4) | Maximum 95-98% |

| Market Growth | 15% annual growth globally | Declining installations |

| Policy Support | $2,000 federal credit + state rebates | Phasing out in many jurisdictions |

| Insurance/Mortgage Risk | Increasingly preferred | Growing concerns about stranded assets |

The Smart Home Mistake: Installing Gadgets That Age Badly

The term “smart home” is a powerful marketing buzzword, but from a valuation perspective, it’s a double-edged sword. Many homeowners invest in trendy, proprietary gadgets that suffer from rapid technological obsolescence, creating more of a liability than an asset at resale. An appraiser must distinguish between “smart decor”—devices that are tied to specific apps, have a short lifespan, and may not be supported in a few years—and “smart infrastructure.” The latter adds durable value because it enhances the home’s core systems in a non-proprietary, user-friendly way.

A voice-controlled faucet or a wall-mounted tablet that will be outdated in three years can be a major turn-off for buyers. They see a potential maintenance headache and a feature they’ll have to pay to remove. In contrast, a smart thermostat that uses an open protocol, a smart electrical panel that provides data on energy usage, or smart water leak detectors offer clear, long-term benefits in safety and efficiency. A recent analysis of home sales data confirms this, showing that while simple, mainstream smart systems can increase appeal, complicated or proprietary systems often deter buyers and can even reduce a home’s perceived value.

The most reliable test for a value-adding smart device is whether it functions perfectly without a Wi-Fi connection. A smart switch must still work as a regular switch, and a smart lock must have a physical key. This ensures the home’s basic functions are never compromised by a server outage or a discontinued product line. True value lies in infrastructure that is robust, upgradable, and simple for a new owner to understand and adopt. Avoid anything that locks the home into a single, niche ecosystem.

- Smart Infrastructure (Adds Lasting Value): Smart thermostats with open protocols, smart electrical panels, whole-home energy monitors, and smart water leak detectors.

- Smart Decor (Avoid for Resale): Proprietary smart bulbs, automated blinds tied to specific apps, voice-controlled faucets, and built-in tablet walls.

- The Un-Smart Test: A device must function perfectly without Wi-Fi. Smart switches should work as regular switches, and smart locks need physical keys.

- Hub Strategy: Install an upgradable central hub and keep connected devices simple and easily replaceable.

When to Replace Windows: Before or After Facade Painting?

Coordination and sequencing are hallmarks of a professional-grade renovation, and they have a direct impact on property value. An appraiser can often spot the work of an amateur versus a pro by observing the details. One of the most common and costly sequencing errors is painting a home’s exterior *before* replacing the windows. While new windows and a fresh coat of paint are both high-impact upgrades, doing them in the wrong order can compromise the performance of both and signal poor planning to a discerning buyer.

The correct sequence is to replace windows first. This is not a matter of preference but of building science. Installing new windows requires cutting into the home’s siding and integrating the window flange with the weather-resistive barrier (WRB). This process ensures a seamless, waterproof seal that protects the wall cavity from moisture intrusion. Painting or installing new siding afterward allows for a clean, integrated finish around the new window frames, covering any tool marks or sealant from the installation. Reversing the order often results in damaged paint or siding, mismatched caulk lines, and a compromised weather seal—all red flags during a home inspection.

Properly executed, the combination of these two projects is powerful. Coordinated correctly, window replacement combined with facade work can achieve a 67% to 95% ROI. This high return is contingent on getting the sequence right to avoid costly touch-ups and ensure the longevity of the investment. The optimal workflow follows a clear, logical path:

- Replace windows first to ensure proper integration with the weather-resistive barrier.

- Allow adequate time (2-3 weeks) for all sealants and insulation around the new windows to fully cure.

- Ensure new window frame colors are coordinated with the planned facade paint scheme before placing the order.

- Complete all facade painting and/or siding work *after* the windows are installed for a seamless and professional finish.

- Budget a 10-15% contingency for potential touch-ups or minor repairs around the new window installations.

When to Upgrade Windows: Before or After Insulating the Attic?

Homeowners often gravitate towards visible upgrades like new windows, assuming they offer the biggest bang for the buck. However, from a building science and valuation perspective, this is a critical error. The most intelligent and profitable renovation strategy embraces the concept of systemic synergy. A house is an interconnected system, and addressing the largest source of energy loss first is paramount. In most homes, that source is not the windows; it’s the attic. Insulating the attic is consistently one of the highest-ROI projects available, with many homeowners typically seeing a 116.9% return on investment.

The strategic value of insulating the attic *before* considering windows or HVAC upgrades cannot be overstated. A well-insulated and air-sealed attic can reduce a home’s overall heat loss by 25-40%. This has a profound ripple effect on all other energy-related decisions. By drastically reducing the heating and cooling load of the house, you may be able to install a smaller, less expensive HVAC system. The performance requirements for your windows may also be reduced, potentially saving you thousands on the total project cost.

This “attic-first” approach is a hallmark of a smart, holistic renovation plan. It prevents the common and costly mistake of installing an oversized HVAC system that will short-cycle, operate inefficiently, and fail to properly dehumidify the air, potentially leading to moisture and mold issues. An appraiser who sees a new, high-efficiency HVAC system but a poorly insulated attic recognizes a missed opportunity and a system that is not performing optimally. True value is created when the components of the home’s energy system are right-sized and work in harmony, a process that must start from the top down.

Why Is It So Hard to Find High-Yield Properties in Major Cities?

In competitive urban real estate markets, properties are often priced efficiently, leaving little room for investors to find high-yield opportunities. The classic “buy and hold” strategy relies on market-wide appreciation. However, a more proactive approach involves manufacturing equity through strategic renovations. This is where energy retrofits move from being a simple upgrade to a powerful investment tool. The strategy is to target “good bones, bad vitals” properties: buildings with sound structures but terrible energy performance, which often trade at a discount.

This creates an opportunity for “retrofit arbitrage.” By investing in a deep energy retrofit, you can significantly increase the property’s value beyond the cost of the renovation itself. For example, a $50,000 investment in insulation, air sealing, and a modern heat pump can easily add $75,000 to $100,000 in value in a prime urban market. The key is to focus on measurable improvements and market them effectively. Documenting before-and-after performance with tools like thermal imaging and pursuing green certifications like LEED or Passive House provides third-party validation that justifies a premium price. Studies have shown that, in a competitive market like California, green-certified homes sold at an average 9% premium.

This split-screen visualization powerfully illustrates the transformation. On one side, a building with clear signs of energy inefficiency; on the other, the same property transformed into a high-performance, desirable asset that commands a higher market value.

This approach reframes the property not just as a place to live, but as a “wellness real estate” asset. By marketing the benefits of superior comfort, quiet operation, and healthier indoor air, you appeal to a sophisticated buyer segment willing to pay a premium for a demonstrably superior product. This is how yield is actively created, not passively awaited.

Key Takeaways

- The highest valuation impact comes from renovations that are systemic (attic insulation first), address future obsolescence (heat pumps), and are properly sequenced.

- “Smart” technology adds value only when it’s open-protocol, non-proprietary infrastructure, not trendy, short-lived gadgets.

- The final frontier of value is the “Wellness Premium,” where documented non-toxic and high-performance materials directly contribute to a higher sale price.

Why Modern Drywall Might Be Making Your Family Sick?

Once the primary energy systems of a home are optimized, the next frontier in property valuation is “wellness real estate.” This growing market segment focuses on how a home’s environment impacts the health and well-being of its occupants. A key, and often overlooked, component of this is the material choice for interior finishes, particularly drywall. Standard drywall can off-gas volatile organic compounds (VOCs) and, if it gets wet, can become a breeding ground for mold. These are not just comfort issues; they are potential health hazards that a growing number of buyers are actively seeking to avoid.

From an appraiser’s viewpoint, a home that can be marketed with a “Healthy Home Portfolio”—a binder containing material certifications for low-VOC paints, formaldehyde-free cabinetry, and specialty drywall—is a premium product. The emerging wellness real estate market shows that homes with documented non-toxic materials can command higher prices. This is because they provide peace of mind and appeal directly to health-conscious families, a highly motivated buyer demographic. The small additional cost for specialty drywall becomes a powerful investment in market differentiation.

Choosing the right type of drywall is a strategic decision that should be tailored to the application. Using mold-resistant drywall in basements and bathrooms protects the larger investment in insulation and framing, while using low-VOC or acoustic drywall in bedrooms and home offices adds a marketable luxury and wellness feature. Even using standard drywall but keeping a documented record of the material data sheets can provide a level of transparency that builds buyer confidence.

| Drywall Type | Added Cost | Value Benefits | Best Applications |

|---|---|---|---|

| Mold-Resistant | 20-30% more | Protects insulation investment, reduces buyer anxiety | Basements, bathrooms |

| Low-VOC | 10-15% more | Wellness premium, healthier indoor air | Bedrooms, nurseries |

| Acoustic | 30-40% more | Luxury feature for families | Between floors, home offices |

| Standard with documentation | No added cost | Peace of mind with material sheets | General use with proper records |

To maximize the resale value of your home, the focus must shift from isolated upgrades to a holistic, risk-mitigation strategy. By future-proofing your home’s core systems, prioritizing systemic synergy, and documenting material quality, you build a compelling case for a premium valuation that will stand up to the scrutiny of any appraiser or discerning buyer. The next logical step is to apply these principles to your own property by conducting a systematic audit of its energy liabilities and opportunities.